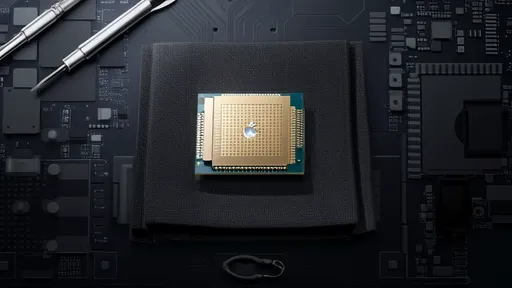

Taiwan Semiconductor Manufacturing Company (TSMC), the world's leading semiconductor foundry, has officially announced the mass production of its cutting-edge 1.4-nanometer (nm) fabrication process. This breakthrough represents the next leap forward in chip manufacturing technology, with Apple's upcoming A18 Pro chipset expected to be the first commercial product utilizing this advanced node.

The 1.4nm process, known internally at TSMC as N1.4, marks a significant milestone in the relentless pursuit of Moore's Law. Industry insiders confirm this development positions TSMC at least a full generation ahead of its closest competitors in the foundry business. The new node promises substantial improvements in power efficiency, transistor density, and performance compared to the current 3nm and upcoming 2nm processes.

Apple, TSMC's most prominent customer, has reportedly secured the initial production capacity for its next-generation A18 Pro processor destined for the iPhone 16 Pro models. The Cupertino-based tech giant has maintained its tradition of being the first to adopt TSMC's newest manufacturing technologies, a strategy that has consistently delivered performance leadership in mobile processors.

Technical advancements in the 1.4nm process include the implementation of gate-all-around (GAA) nanosheet transistors, a more refined version of the technology that will debut in TSMC's 2nm node. This architectural improvement allows for better control of current flow through transistors while minimizing leakage - a critical factor as features shrink to atomic scales. The node also incorporates backside power delivery, a revolutionary approach that separates power and signal wiring to reduce interference and improve efficiency.

Early performance estimates suggest the 1.4nm process could deliver up to 25% better power efficiency or 15% higher performance at the same power level compared to TSMC's second-generation 3nm technology. Transistor density is expected to increase by approximately 30%, enabling chip designers to pack more functionality into the same silicon area or create smaller chips with equivalent capabilities.

The semiconductor industry has been closely watching TSMC's progress with its post-2nm technologies. While Intel and Samsung have announced their own roadmaps for similar process nodes, TSMC appears to have secured a comfortable lead in both development timeline and production readiness. This advantage reinforces Taiwan's position as the global epicenter of advanced chip manufacturing despite growing geopolitical tensions.

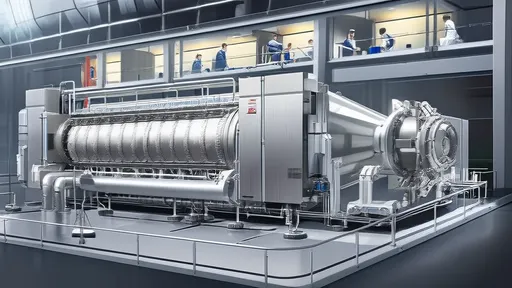

Production challenges at these extreme scales cannot be overstated. The 1.4nm process requires unprecedented precision in manufacturing, with EUV (extreme ultraviolet) lithography systems becoming even more critical. TSMC has reportedly worked closely with ASML to optimize its high-NA (numerical aperture) EUV machines for the new node. Yield rates during early production phases will be closely guarded secrets, though industry analysts suggest Apple's willingness to pay premium prices helps mitigate TSMC's initial risk.

For Apple, being first to market with 1.4nm technology provides multiple strategic advantages. The A18 Pro is expected to power not just the iPhone 16 Pro series but also future iPad Pro models and potentially even entry-level Mac computers. The efficiency gains could translate to better battery life, while the performance improvements may enable more advanced artificial intelligence and machine learning capabilities directly on device.

Supply chain sources indicate that risk production for the A18 Pro began in late 2023, with volume production ramping up through the first half of 2024. This timeline suggests Apple remains on track for its traditional September iPhone launch window. The A18 Pro will likely be paired with an enhanced version of Qualcomm's Snapdragon X75 modem, also manufactured by TSMC though on a more mature process node.

Beyond Apple, other major TSMC customers including AMD, NVIDIA, and Qualcomm are expected to adopt the 1.4nm process for their flagship products in 2025 and beyond. However, the staggering costs associated with cutting-edge semiconductor manufacturing mean only the most profitable chips with sufficient volume will justify the transition in the near term.

The environmental impact of advanced semiconductor manufacturing continues to grow as process nodes shrink. TSMC has committed to using 100% renewable energy for all its 1.4nm production, though skeptics question whether this pledge can be realistically fulfilled given Taiwan's energy infrastructure limitations. Water usage and chemical waste management remain significant challenges that the company must address as it scales production.

Geopolitical considerations add another layer of complexity to TSMC's 1.4nm ambitions. The Taiwanese government has implemented strict controls on the export of advanced semiconductor technology, while the United States continues to pressure TSMC to expand production capacity on American soil. TSMC's Arizona fab, currently tooling up for 4nm production, won't receive 1.4nm capabilities anytime soon, maintaining Taiwan's monopoly on the most advanced processes.

Looking ahead, TSMC has already begun research on 1nm-class and even sub-nanometer processes, though the physical and economic limits of silicon-based semiconductors are becoming increasingly apparent. Alternative materials like graphene and novel architectures such as complementary field-effect transistors (CFETs) may eventually supplement or replace current approaches as the industry pushes beyond the 1nm barrier.

For consumers, the practical benefits of 1.4nm technology will manifest in devices that are simultaneously more powerful and energy efficient. The A18 Pro is expected to enable new categories of mobile experiences, particularly in augmented reality and on-device AI processing. However, with smartphone sales plateauing globally, the industry will need to identify new applications to justify the enormous R&D investments required for each successive process node.

The successful mass production of 1.4nm chips represents both a technological triumph and a reminder of the semiconductor industry's growing complexity. As TSMC cements its leadership position, the entire electronics ecosystem must adapt to the realities of a world where only a handful of companies can afford to play at the cutting edge of silicon manufacturing.

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025

By /Jun 20, 2025